🟨👀 This Insider Purchased Over $4M of Stock since February

Plus 6 insiders at $BW bought the stock this week

Happy Friday!

Let’s take a look at the best CEO trades from this week

Buying the Bank that Acquired SVB’s assets

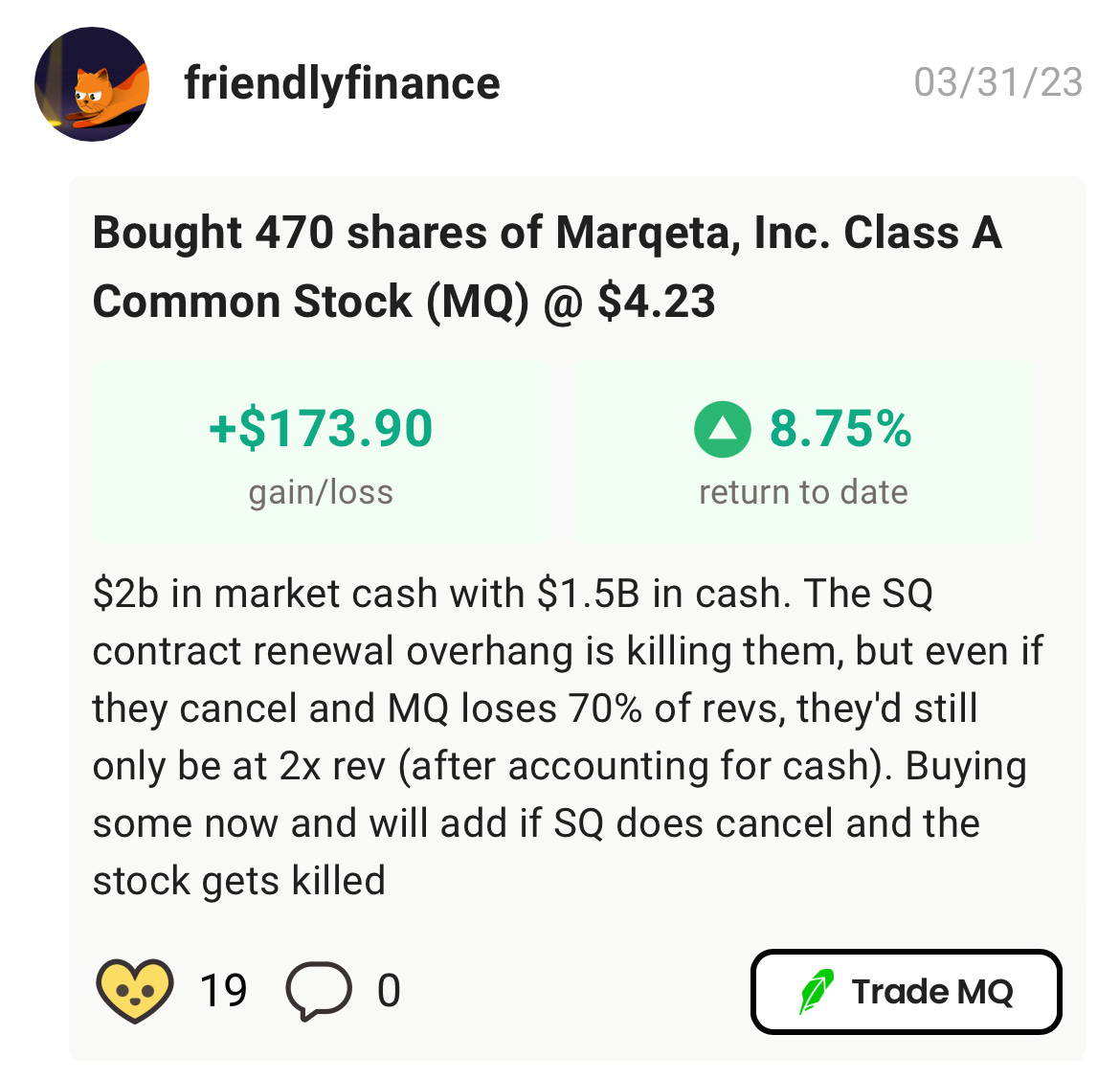

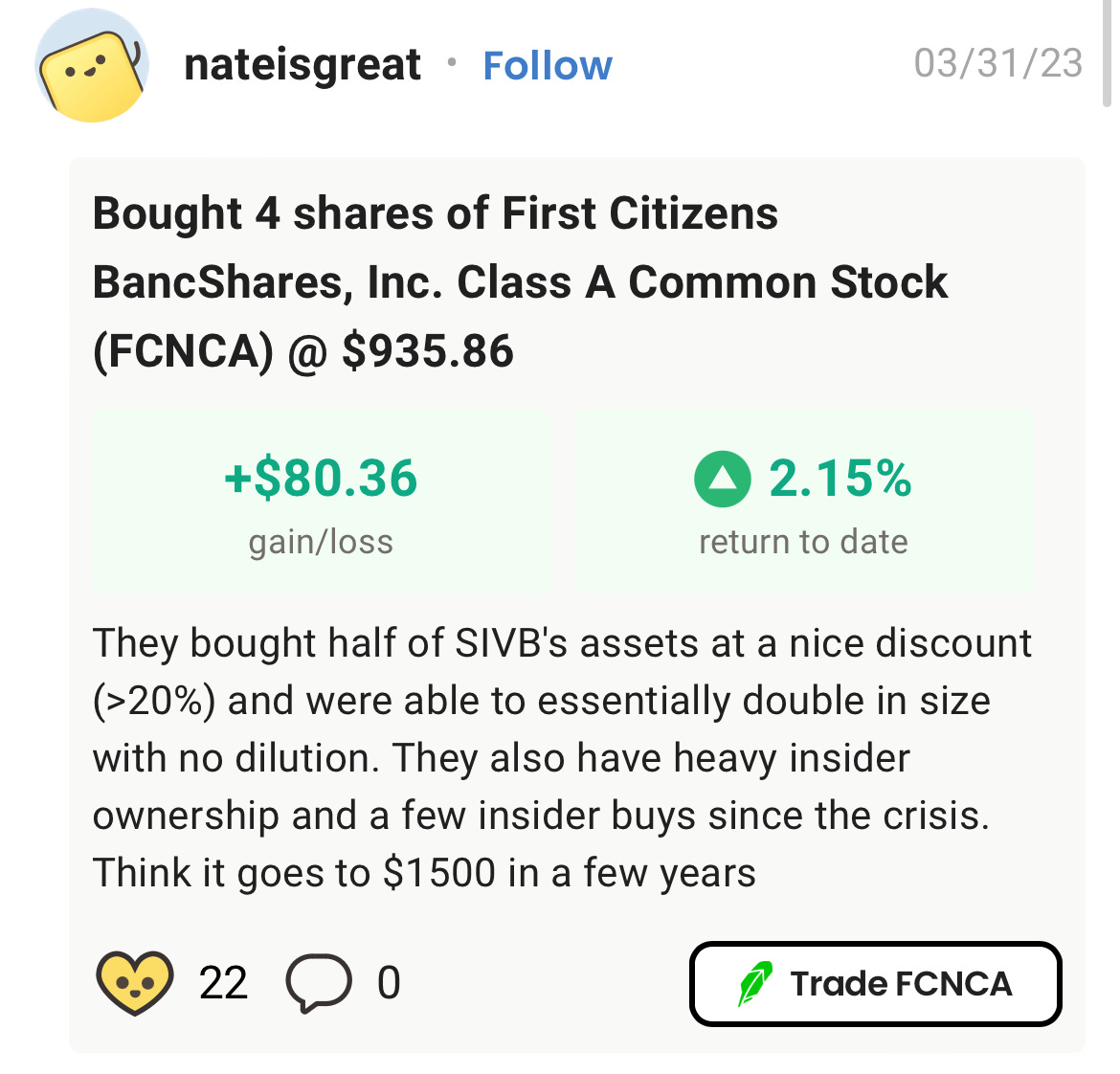

Below are a couple of my favorite trades from Yellowbrick this week. Yellowbrick is our main project and is a social investing platform where users connect their brokerage and anonymously share their trades (with the reason they bought the trade), holdings, and returns. You can see a feed of the best trades from other users on Yellowbrick alongside the public profiles we curate like Nancy Pelosi and the CEOWatcher account.

A good risk/reward bet on MQ that is already up 10%

The bank that acquired Silicon Valley Bank’s assets

Join Yellowbrick to find your next trade idea by seeing a feed of the top trades!

Top CEO Trades of the Week

Reminder: you can read about how CEO Watcher works and how we calculate returns and win rates here

Beth Seidenberg - Director at VERA 1.33%↑ (link)

*This is the third week we have found Beth as she just keeps buying

I tried avoiding this stock for as long as possible because it’s a risky biotech company and Beth didn’t have a ton of history, but she keeps buying a ton of the stock (on behalf of Kleiner Perkins where she is a GP).

Beth has only made three purchases before she started buying VERA, but she has now bought VERA 11 times since February 9th at an average price of ~7.16 for a total of $4.3M. Notably, the stock plunged in December after mixed data from one of their trials and it’s now sitting 60% below where it was trading in November.

Three previous purchases (before buying VERA):

2019-10-30 (+145% 90-day returns | +90% 1-year returns)

2016-03-18 (+19% 90-day returns | +332% 1-year returns)

2012-07-06 (+11% 90-day returns | +145% 1-year returns)

Returns and Win Rate

Overall: 127% returns with a 100% win rate (13/13 trades)

1-year: 317% returns with a 100% win rate (3/3 trades)

90-day: 21% returns with a 100% win rate (3/3 trades)

Purchase Data (this week)

Total Amount Purchased: $198,294.1

Purchase Price: $7.24

Current Price: $7.44 (+3%)

Rating

Rating: 8

Why: The only downside here is the lack of history (only 3 previous trades before she started buying VERA), but everything else looks good: the stock price is down significantly, she has been buying up a bunch of the stock over the last month, and she has great returns.

Louis Salamone - CFO at BW (link)

The CEO, COO, CFO (👆 guy), and 3 directors all bought BW this week. The CFO also triggered our alerts due to his returns.

Returns and Win Rate

Overall: 45% returns with a 88% win rate (7/8 trades)

1-year: 92% returns with a 67% win rate (4/6 trades)

90-day: 38% returns with a 75% win rate (6/8 trades)

Purchase Data (this week)

Total Amount Purchased: $79,110

Purchase Price: $5.27

Current Price: $6.01 (+14%)

Rating

Rating: 7

Why: Always a strong signal when a group of execs are buying the stock and at least one of them has a good track record. However, this purchase isn’t abnormally large and the stock is already up 14% since the purchase.

Mahesh Patel - CEO at LPCN 0.00%↑ (link)

A tiny-cap pharma company where the CEO bought the stock twice this week after the stock fell 20% in the last month.

Returns and Win Rate

Overall: -10% returns with a 14% win rate (2/14 trades)

1-year: 98% returns with an 80% win rate (8/10 trades)

90-day: 13% returns with an 85% win rate (11/13 trades)

Purchase Data (this week)

Total Amount Purchased: $64,500

Purchase Price: $0.32

Current Price: $0.32 (+0%)

Rating

Rating: 5

Why: He has great 1-year returns, but the tiny market cap, low volume, and industry (pharma), make it tough to go very high here.

Philippe Katz - Director at KODK 0.00%↑ (link)

Two directors at Kodak bought stock this week, including Philippe Katz who made his 6th purchase ever (and first since 2020) by picking up $40k.

His previous 5 trades:

2020-06-24 - Purchased $11k (+352% 90-day returns | +313% 1-year returns)

2020-06-15 - Purchased $12k (+162% 90-day returns | +255% 1-year returns)

2020-03-24 - Purchased $69k (+31% 90-day returns | +345% 1-year returns)

2019-12-05 - Purchased $5.5M (+18% 90-day returns | +200% 1-year returns)

2019-08-15 - Purchased $83k (+16% 90-day returns | +308% 1-year returns)

Returns and Win Rate

Overall: 60% returns with a 100% win rate (5/5 trades)

1-year: 200% returns with a 100% win rate (5/5 trades)

90-day: 19% returns with a 100% win rate (5/5 trades)

Purchase Data (this week)

Total Amount Purchased: $38,500

Purchase Price: $3.85

Current Price: $4.14 (+7%)

Rating

Rating: 5

Why: While he has great historical returns, the purchase size isn’t very big and all of his returns come from the massive meme-stock pump in 2020.

Join Yellowbrick to find your next trade idea by seeing a feed of the top trades!

Have a great weekend!

Connor