Hello!

There is a lot of crazy stuff happening in the bank world (with lots of insider buying going on). Let’s take a look!

Bank Insiders that are Buying their Stock

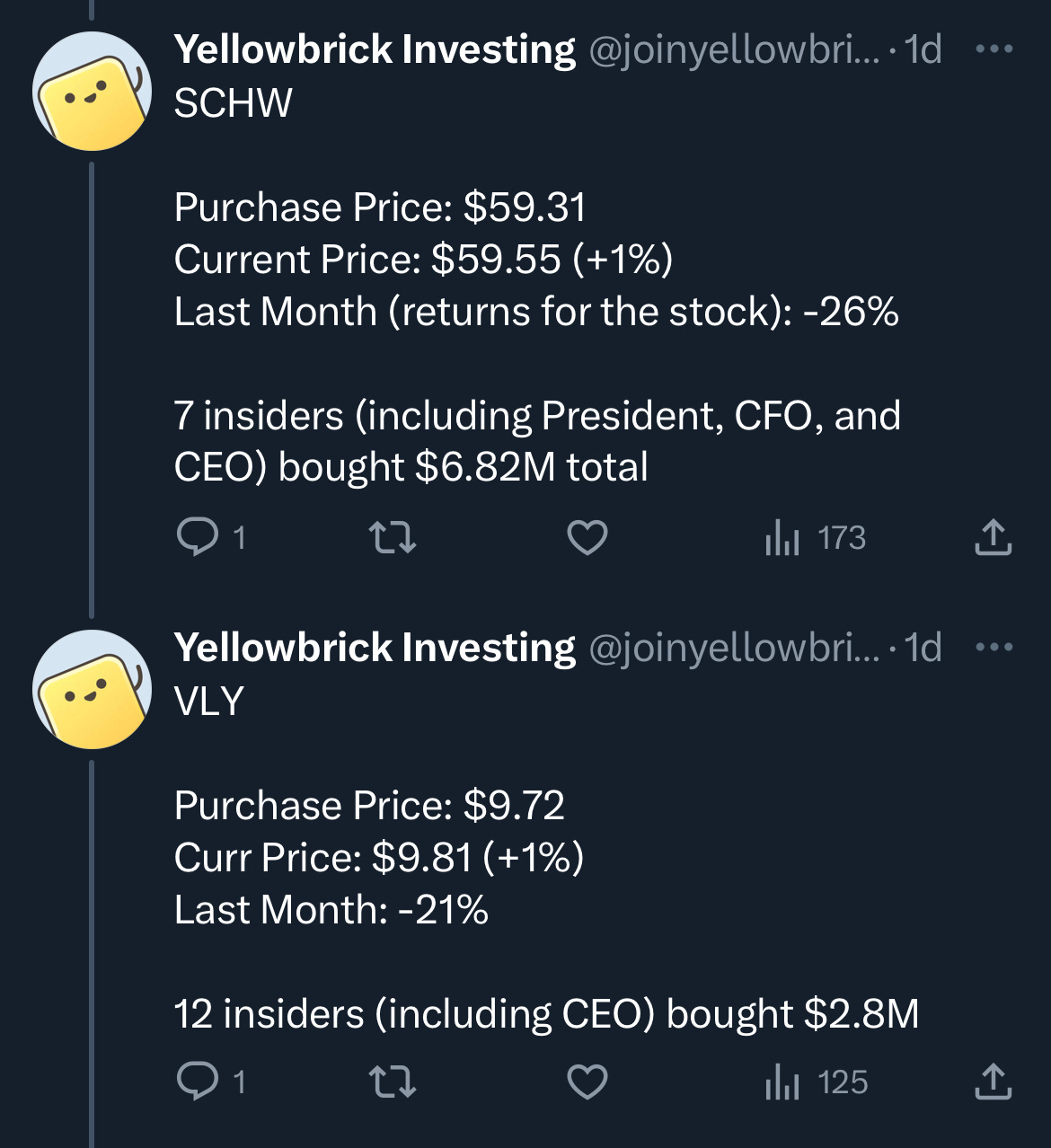

If you missed our email yesterday, we put out a Twitter thread (link) with all of the banks where insiders are buying the stock after the crash in bank stocks.

Check it out for some great buying opportunities like SCHW or VLU (both pictured below)

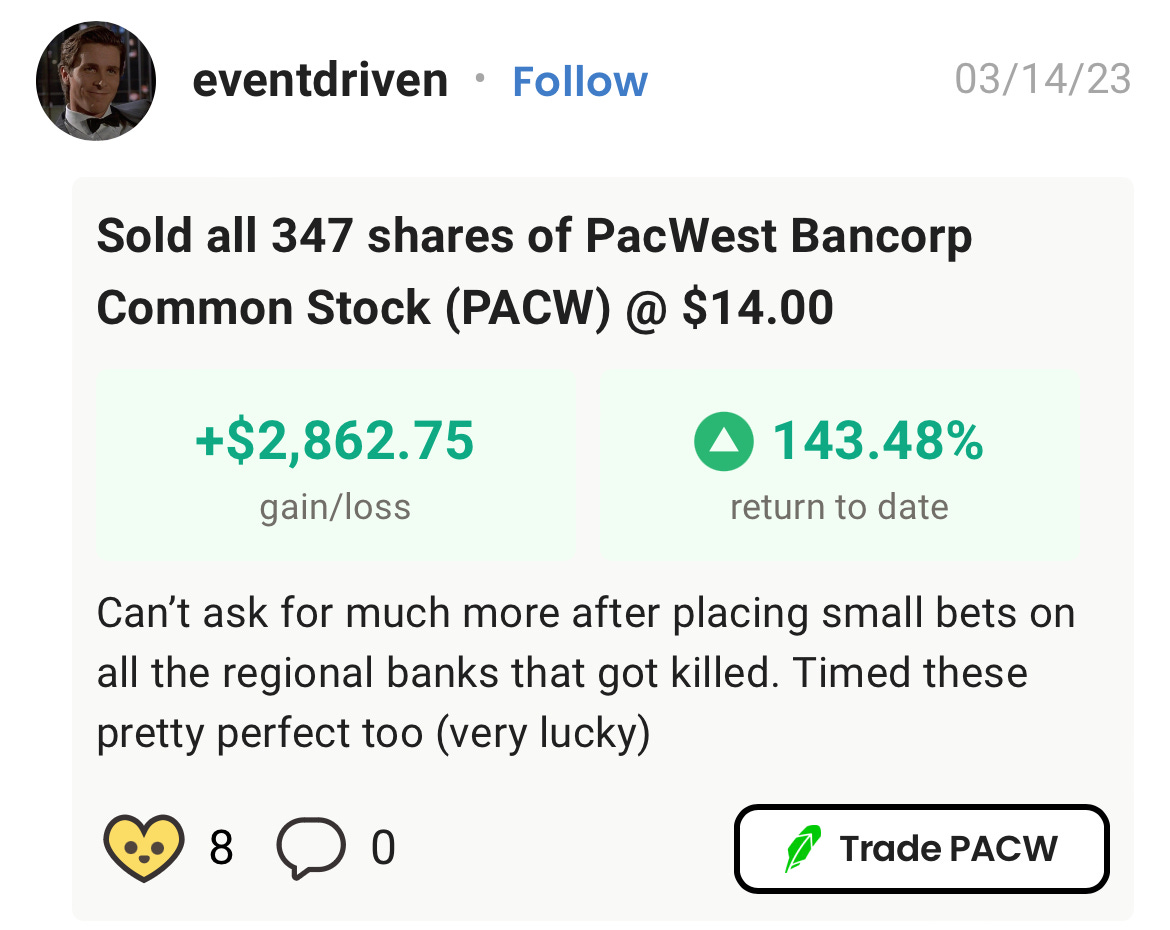

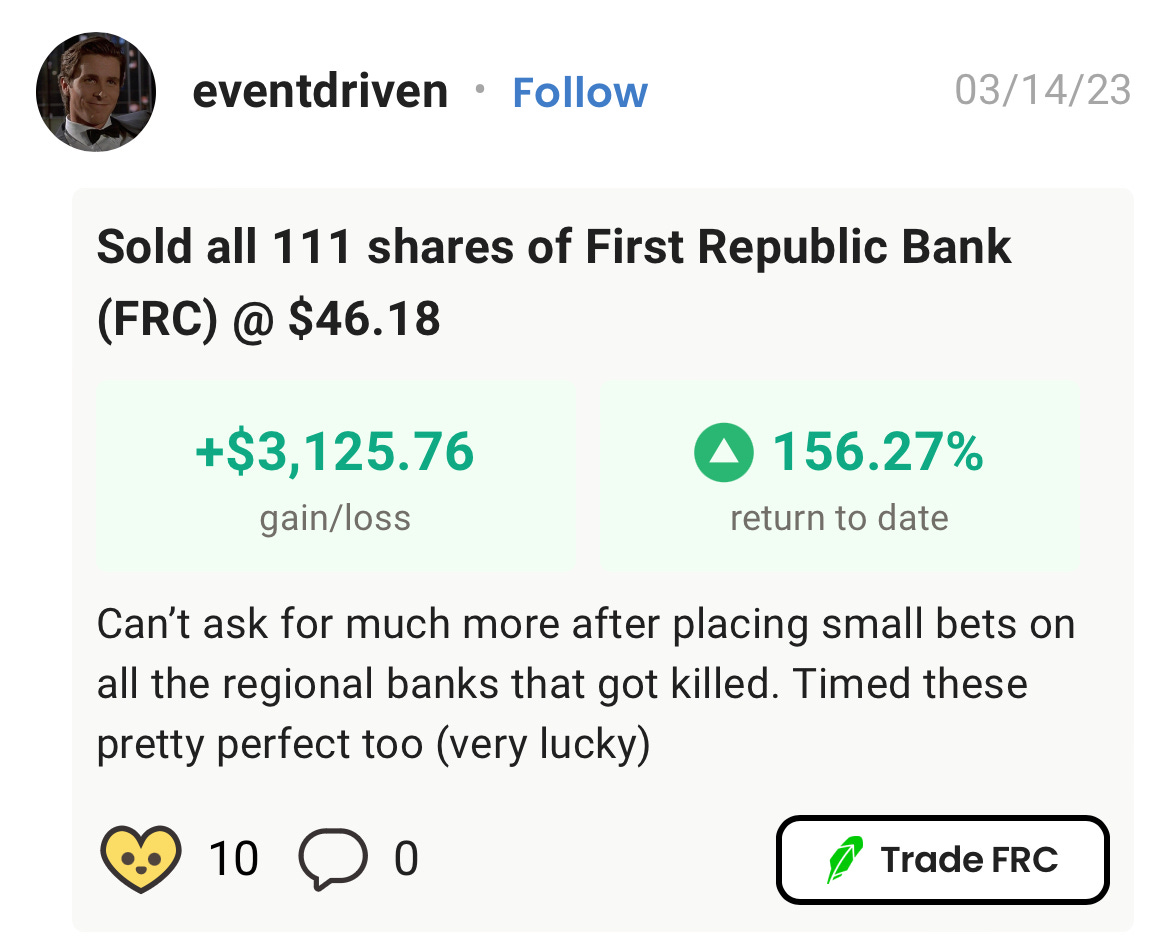

313% Returns in One Day on a Bank Stock

This week on Yellowbrick, a handful of investors played the bank stock collapse, but none did it better than eventdriven who nearly nailed the bottom with their purchases on Monday and sold at the top on Tuesday.

As previous readers will know, our main project is Yellowbrick, a social investing platform where users connect their brokerage and anonymously share their trades (with the reason they bought the trade), holdings, and returns. You can see a feed of the best trades from other users on Yellowbrick alongside the public profiles we curate like Nancy Pelosi and the CEOWatcher account.

Join Yellowbrick to find your next trade idea by seeing a feed of the top trades!

Top CEO Trades of the Week

Reminder: you can read about how CEO Watcher works and how we calculate returns and win rates here

Robert Baty - Director at MTDR 0.00%↑ (link)

The CEO, President, EVP of Engineering, and two other directors also bought a bunch of stock this week at prices from $44.75 - $49.15. Their purchases were also larger than their average.

Returns and Win Rate

*data for Robert Baty, not all insiders

Overall: 318% returns with a 100% win rate (6/6 trades)

1-year: 231% returns with an 83% win rate (5/6 trades)

90-day: 65% returns with a 67% win rate (4/6 trades)

Purchase Data (this week)

*data for all insiders, not just Baty

Total Amount Purchased: $298,508

Purchase Price: $44.75 - $49.15

Current Price: $43.48

Rating

Rating: 8

Why: Many insiders making large purchases on a stock down 26% in the last month is a great sign. The only thing holding this down is that the stock is up an insane 14x since COVID which makes all the executive trade returns look awesome (if they bought at any time over the last 3 years, they are up a ton).

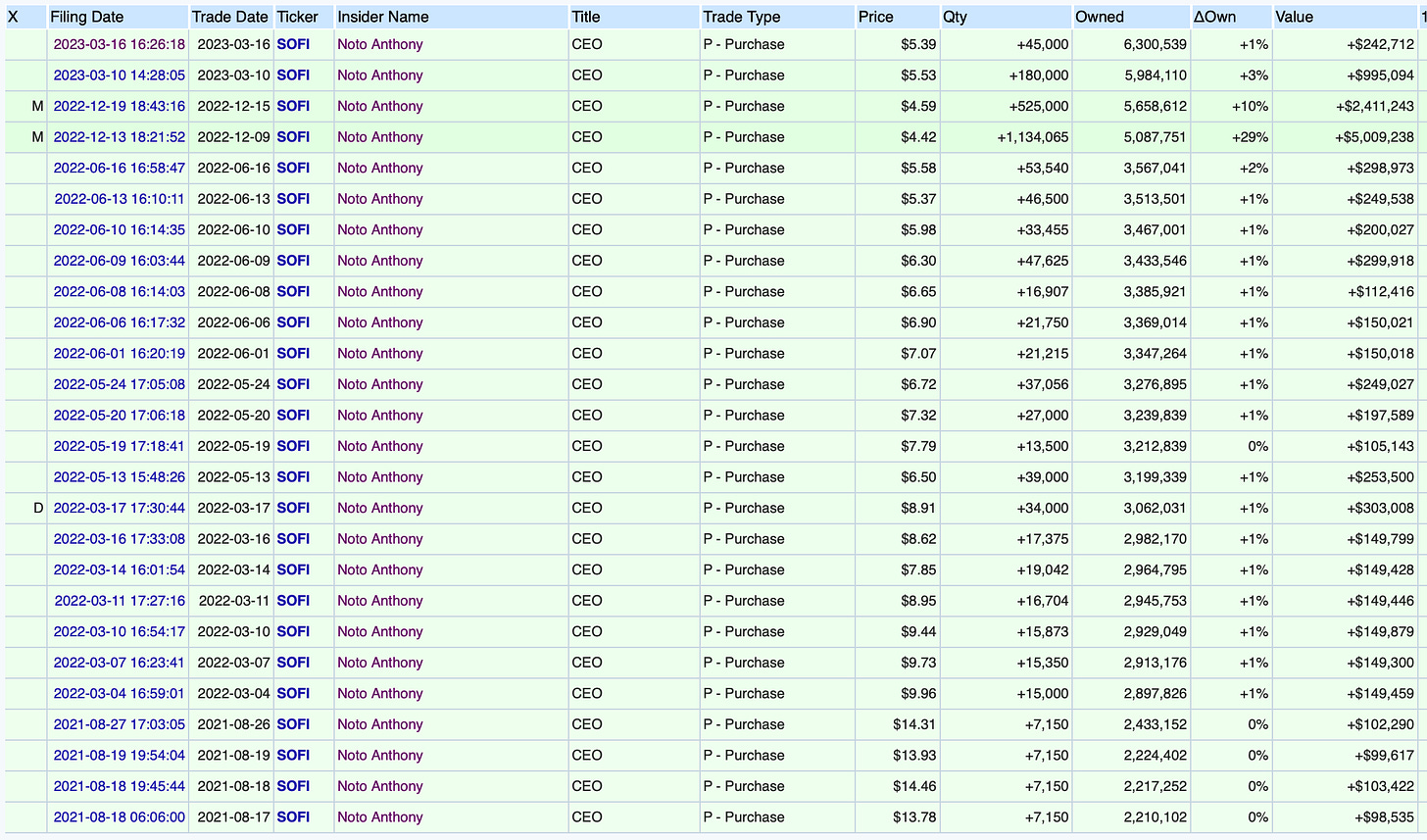

Anthony Soto - CEO at SOFI 0.00%↑ (link)

If you’ve followed SOFI at all, you probably know that Anthony has bought a ton of stock in the past and it has worked out pretty poorly for him.

As you can see below, he has purchased stock 32 times (not all fit in the image) since they went public and is underwater quite a bit on nearly all of those trades. There are four reasons I find this interesting even though he hasn’t done a great job buying so far:

He SUPER ramped up his purchases sizes in December when the stock was under $5

He has bought the stock twice this week after the banking debacle

The two purchases this week combine to be his second biggest week of purchases (besides the week in December when the stock was under $5)

~36% of the $34M of SOFI he owns are from his open market purchases which is massive

Returns and Win Rate

Overall: 12% returns with a 31% win rate (10/32 trades)

1-year: -40% returns with a 6% win rate (1/16 trades)

90-day: 8% returns with a 34% win rate (10/29 trades)

Purchase Data (this week)

Total Amount Purchased: $1,237,806

Purchase Price: $5.50

Current Price: $5.47 (+3.3%)

Rating

Rating: 7

Why: His historic returns just aren’t good, but the four things mentioned above make this a very intriguing buy. If you are making any bank/finance trades to catch the dip, this is a good one to look at.

Google Ventures - 10% Owner at GTLB 0.00%↑ (link)

This is an interesting one because it is Google’s Venture arm buying up GTLB stock on the dip (which they have done 6 times now). They have basically bought up every GTLB dip and done incredibly well on it (averaging 60% 90-day returns).

Returns and Win Rate

Overall: 9% returns with a 100% win rate (5/5 trades)

1-year: N/A returns with a N/A win rate (0/0 trades)

90-day: 60% returns with a 100% win rate (5/5 trades)

Purchase Data (this week)

Total Amount Purchased: $18,988,100

Purchase Price: $29.70

Current Price: $36.20 (+22%)

Rating

Rating: 6

Why: The stock has already recovered 22% since they made the purchase which removes some of the upside (though it is still down 16% this month). Google Ventures average purchase price for Gitlab is ~$33 (across all 6 purchases), so I’ll be keeping an eye on this one to see if it drops back down into that range.

Thomas Schuetz - CEO at CMPX 0.00 (link)

Note: we’ve written about this guy a few times already, but he just keeps buying shares

Thomas has been gobbling up shares since May of 2022. This is his 23rd purchase of CMPX and 21 of them have happened since May of 2022 (and he has basically been buying more every two weeks since the stock fell again in January). Because of this, we don’t have a ton of long-term history on him. However, his 90-day returns have been great and he just started repurchasing the stock after pausing from the end of September til now. The stock is also down over 35% in the last 2 months.

CMPX is a therapeutics company and it sounds like their focus right now is their biliary tract cancer candidate, CTX-009. It has had some promising results through 2022 (which pushed the price from $1.50 to almost $5.50 at the end of last year before it dropped back down to around $4), but it doesn’t sound like the final results will come until January 2024.

Returns and Win Rate

Overall: 42% returns with an 86% win rate (19/22 trades)

1-year: 62% returns with a 100% win rate (2/2 trades)

90-day: 46% returns with a 94% win rate (17/18 trades)

Purchase Data

Total Amount Purchased: $33,700

Purchase Price: $3.37

Current Price: $3.31 (-2%)

Rating

Rating: 5/10

Why: The inherent riskiness of bio companies makes it tough for me to give them a very high grade (and this purchase is pretty small - he typically buys over $75k). However, it definitely appears that he believes they are undervalued at sub-$4, so if this is a space you like, it’s probably worth looking into.

Have a great weekend!

Connor V.