Hello everyone!

Let’s dive right in!

Nancy Pelosi added to Yellowbrick!

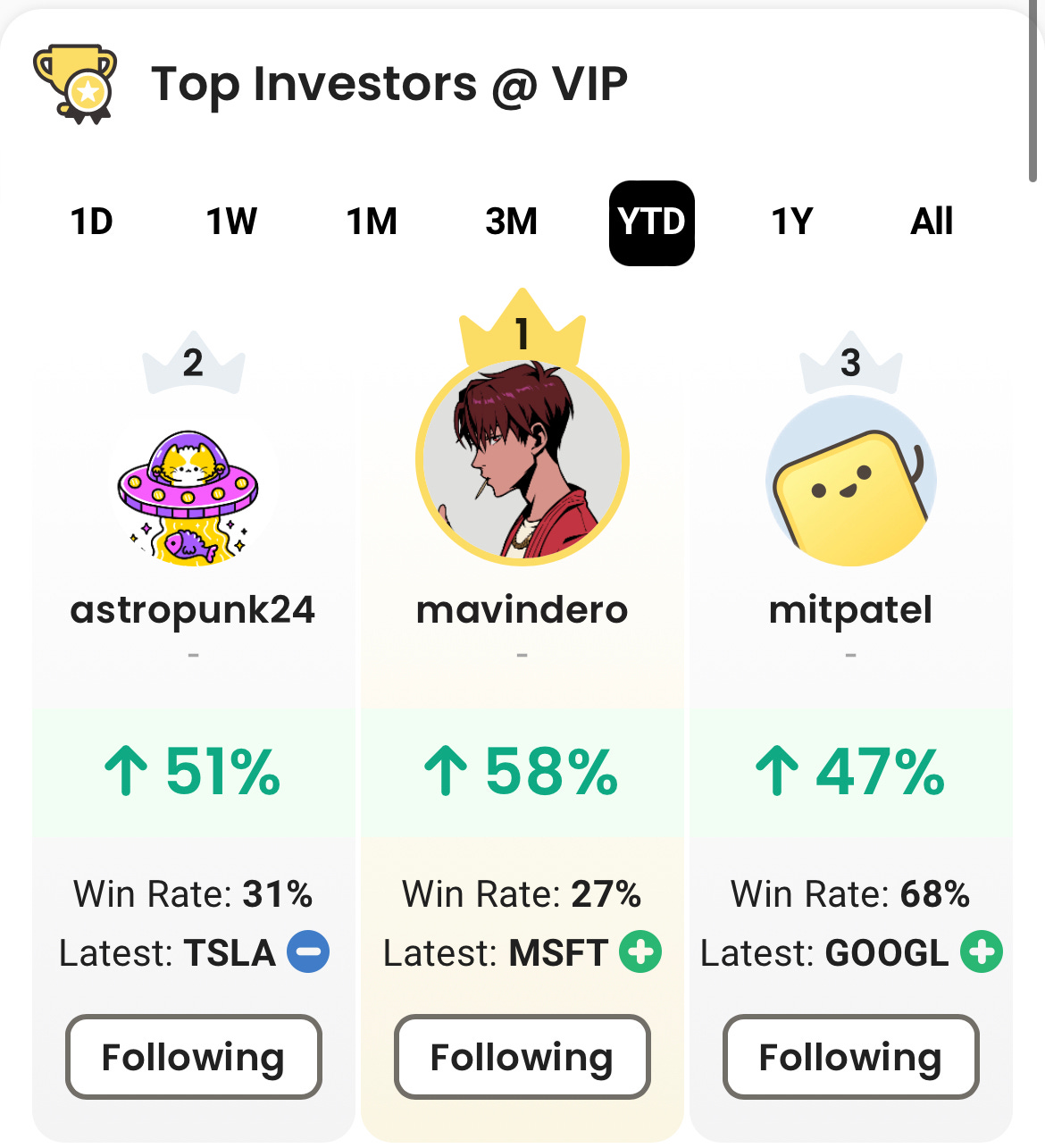

As many of you know, the main project my team and I are working on is a social stocks platform called Yellowbrick. You connect your brokerage and then are able to see the verified trades, holdings, and returns of other investors on the platform. We’ve even got a nifty leaderboard to help you find other investors to follow (image below).

Well, we just added a Nancy Pelosi profile on Yellowbrick as well! So if you join Yellowbrick, you can see her insane $100M portfolio, all of her trades all the way back to 2007 when she was buying AAPL for under $5, and get notified when she makes new trades.

So if you have a Robinhood account, make sure to join Yellowbrick!

Top CEO Trades of the Week

Reminder: you can read about how CEO Watcher works and how we calculate returns and win rates here

Frank Holding - CEO at FCNCA 0.00%↑ (link)

Frank has made 32 purchases of FCNCA since 2011 and has had some pretty great timing. This can be demonstrated by his 2022 purchases when he bought up nearly $750k of stock during May and June when the price was at a relative low ($630) before the stock shot up to over $850 at the end of the year. He then held off on buying until now when the stock dropped 15% back to $722.

He has been particularly good since 2016. He has made 20 trades and only had negative 90-day returns one time (95% win rate) and negative 1-year returns twice (90% win rate) while averaging 22% 90-day returns and 23% 1-year returns.

Returns and Win Rate

Overall: 133% average returns with a 100% win rate (32/32 trades were profitable)

1-year: 21% returns one year after purchasing with a 62% win rate (24/39 trades)

90-day: 17% returns with a 66% win rate (21/32 trades)

Purchase Data

Total Amount Purchased: $736,960

Purchase Price: $722.51

Current Price: $764.71 (+6%)

Rating

Rating: 7/10

Why: He doesn’t have the greatest 90-day and 1-year returns of all time, but he has been very good (especially since 2016). With the stock dropping 15% in the last month, it looks like he is buying another dip.

Leighton Thomson - CEO at AKAM -0.24%↓ (link)

We first found that Leighton had kicked off a 10b5-1 plan to start buying up his company’s stock in our first email of this year. Go check out that email for more info (link), but the gist is that he has twice before gone on a buying spree (in 2016 and 2017) and did quite well with those (56% and 67% overall returns respectively on those buying sprees).

His overall win rate has dropped quite a bit because the current stock price is below the price he has been paying on this most recent purchase spree (so all of those count as unprofitable for now), but he still has fantastic returns.

Returns and Win Rate

Overall: 100% average returns with a 73% win rate (30/41 trades were profitable)

1-year: 28% returns one year after purchasing with a 63% win rate (15/24 trades)

90-day: 12% returns with a 63% win rate (15/24 trades)

Purchase Data

Total Amount Purchased: $125,234.5

Purchase Price: $88.90

Current Price: $86.01 (-3%)

Rating

Rating: 7/10

Why: He’s done this twice before with great success, so I think there is a good chance the 3rd time works out pretty well too.

Brian Pratt - Chairman at LGTO 0.00%↑ (link)

LGTO is a SPAC that has a vote on Tuesday for whether they merge with Southland Holdings, one of the largest infrastructure construction companies in North America. I would have to imagine Brian is only buying because he knows it will go through, but I am less confident that it will actually be good for the stock price as SPAC’s have a pretty terrible reputation.

Returns and Win Rate

Overall: 120% average returns with a 100% win rate (5/5 trades were profitable)

1-year: 27% returns one year after purchasing with an 80% win rate (4/5 trades)

90-day: 74% returns with an 80% win rate (4/5 trades)

Purchase Data

Total Amount Purchased: $1,544,500

Purchase Price: $10.30

Current Price: $10.30 (+0%)

Rating

Rating: 6/10

Why: The major downside here is that I’m simply not sure if people are going to be happy this SPAC finally completes a merger which will cause the price to pop or if SPACs have such a terrible reputation that the price will plummet. We also don’t have a ton of history on Brian (only 5 previous trades), but he has had great success with those trades. His last purchase was a $500k purchase of ESOA 0.00%↑ on 2021-01-07, which was literally 4 days before it popped over 100%. This is also his largest purchase and over 3x bigger than his second largest purchase (the ESOA trade). Really, my only reservation here is just that I have no idea how the market will react to a SPAC merging.

Ronald G Roth - Chairman at CLFD 0.00%↑ (link)

This one is a little tough to read. For the last three years, he bought the stock around February 10th (2020-02-11, 2021-02-11, 2022-02-10, 2023-02-07). Typically, that would make me think these are just yearly, scheduled purchases, but he never implemented a 10b5-1 plan and his returns on the first two of these trades are really good (+450% on the 2020 trade and +90% on the 2021 trade, but he is flat on the 2022 trade).

His overall returns are also incredible, but a lot of that is because he has been buying CLFD stock since 2011 when the price was in the single digits (it’s above $60 now).

Returns and Win Rate

Overall: 500% average returns with a 100% win rate (35/35 trades were profitable)

1-year: 27% returns one year after purchasing with a 58% win rate (20/34 trades)

90-day: 7% returns with a 57% win rate (20/35 trades)

Purchase Data

Total Amount Purchased: $198,400

Purchase Price: $64

Current Price: $62 (-3%)

Rating

Rating: 5/10

Why: A really tough read here. His overall returns are skewed by his stock purchases a decade ago and his 90-day/1-year returns are pretty good, but not incredible. The fact that he has bought the stock around the same date 4 years in a row also has me wondering if this has just become a normal purchase time for him. The main positive for this trade is that it is his largest purchase since 2015 and 3.5x larger than the 2020 and 2021 trade (and 50% larger than last year’s). Two out of the last three times he bought stock in February, the returns were incredible. Will this be the third time?

Have a great weekend!

Connor